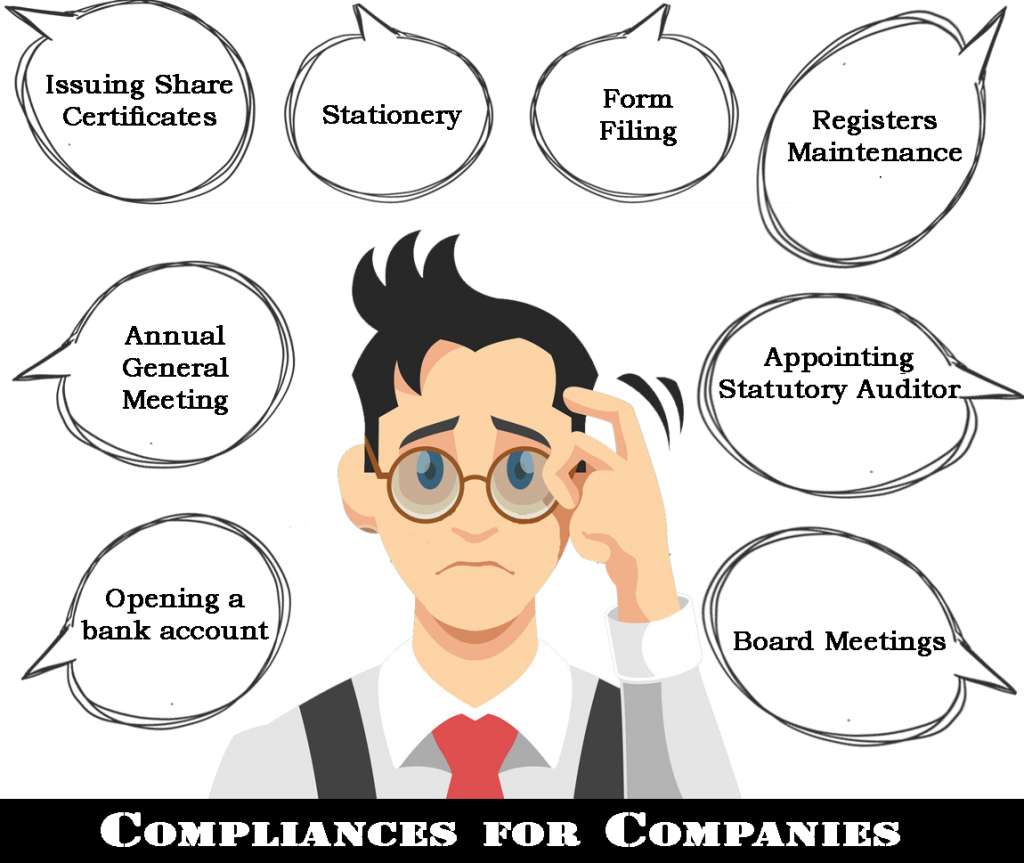

If you incorporate a company under the Companies Act, 2013, then you need to adhere to certain compliances. Further, compliances for companies cover the aspects of directors of the company, meetings, and maintenance of the book of accounts. In this article, we will share the list of compliances for companies that you need to keep in mind after you incorporate your company.

Compliances for Companies Post-Incorporation

The Companies Act, 2013, regulates the working of a company. Further, it has listed several compliances for companies to follow. These are:

1. Opening a Bank Account

A company must open a bank account in the name of the company for carrying on business transactions. Further, as soon as the account is opened, you need to deposit the paid-up capital in the account. This is the capital used to incorporate the company. Also, you need to deposit this amount within 60 days from the date of incorporation of the company. Here are the documents required for opening a bank account:

- Board Resolution passed in the first Board Meeting.

- Copy of the PAN Card.

- Memorandum of Association of the Company.

- Articles of Association of the Company.

- All other documents that the bank specifies.

2. Stationery

You need to procure stationery items like the Common Seal, Rubber Stamp, Statutory Register, Business Cards, and Letterheads with the company’s name engraved on them. Further, the letterhead of the company must include the following points:

- Full Name of the Company.

- Also, the complete registered address of the Company.

- Corporate Identification Number or CIN.

- Also, the corporate email Id, contact number and website if any.

3. Appointment of a Statutory Auditor

Every company must appoint a statutory auditor within 30 days from the date of its incorporation. Further, the company needs to pass a resolution at a Board Meeting for the same. Also, if the Board fails to appoint such an auditor, the members of the company can do the same. However, the members must ensure that they appoint the auditor within 90 days at an extraordinary general meeting. Also, such an auditor shall hold office until the conclusion of the first general meeting.

4. Compliances for Companies with respect to Board Meetings

Every company must hold its first Board Meeting within 30 days from the date of its incorporation. The agenda must include:

- Taking note of the Certificate of Incorporation.

- Appointing the first director. Also, constituting the board.

- Taking note of the Registered Office of the Company.

- Appointing the first auditor of the company.

- Adopting a common seal.

- Taking note of the financial year of the company.

- Considering subscribers to the memorandum.

- Also, printing share certificates.

- Taking note of preliminary expenses.

- Taking note of Disclosure of Interest of Directors via Form MBP 1. Also, taking note of Confirmation Received from Directors via Form DIR8.

- Approving the opening of a bank account.

- Authorizing business registration and e-forms.

- Discussing directors’ fees.

- Also, any other business with the chair’s permission.

5. Statutory Register maintenance

Every company is required to maintain a set of statutory registers and a minute book of meetings. These include Registers of

- Members – MGT 1.

- Debenture Holders – MGT 2.

- Foreign Registered Members. Also, Debenture holders and other security holders- MGT 3.

- Renewed and Duplicate Share Certificate- SH 2.

- Sweat Equity Shares- SH 3.

- Employee Stock Options SH 6.

- Directors and KMPs.

- Shares/Other Securities Bought Back- SH 10.

- Deposits.

- Charges- CHG 7.

- Loans/Guarantee/Security and Acquisition by Company- MBP 2.

- Contracts or Arrangements in which Directors are interested- MBP 4.

Also, the company needs to maintain a register and index of beneficial owners.

6. Share Certificate Issuance

Post-incorporation, a company must issue share certificates to its shareholders within 60 days of incorporation.

7. Annual General Meeting

With the exception of a One-Person Company, every company is required to hold its first annual general meeting within 9 months from the date of closing of the first financial year. Further, the company must hold subsequent meetings within 6 months from the date of closing of the financial year. Also, if a company is holding its first meeting, then it need not hold an annual general meeting in the year of its incorporation.

8. Filing of Forms with the Registrar of Companies (ROC)

In accordance with the Annual General Meeting, every company must file their financial statement and annual return with the ROC every year. Also, if the Companies Act, 2013, requires the company to file some other forms, then the company needs to comply with that too.

Compliances for Companies – Quarterly Compliance Requirement

Every company must hold at least 4 Board Meetings in each calendar year. Further, the interval between two consecutive meetings cannot exceed 120 days. Hence, the companies must hold one Board Meeting every quarter.

The companies that are exempted from this compliance are – One-Person Companies, Small Companies, and Dormant Companies. Further, these companies need to hold one Board Meeting in each half of the calendar year. Also, the interval between two consecutive meetings should exceed 90 days.

Compliances for Companies – Annual Compliance Requirement

With the exception of a One-Person Company, every company is required to hold its first annual general meeting within 9 months from the date of closing of the first financial year. Further, the company must hold subsequent meetings within 6 months from the date of closing of the financial year.

Summing Up

As you can see, the Companies Act, 2013, has an elaborate list of compliances for companies. Also, every company must ensure that it adheres to these compliances regularly. In case you need any clarification regarding any compliance, then please feel free to write to us.