In recent years, India has grown in popularity as a country of startups. The entrepreneurial spirit in our country has been the highest in decades. Hence, it is no surprise that the number of registrations of companies has skyrocketed too. As experts in helping companies register their businesses, we have dealt with almost all roadblocks that can surface during the process. Our team of experts is always at your call to guide and assist you to register your business. In this article, we will talk about a private limited company and understand its types and features.

Let’s start with some basics:

What is a Private Limited Company?

To understand a Private Limited Company, let’s look at the three terms individually:

- Company – A business entity that is taxed and accounted separately. Further, an association of people creates a company. Also, a company can engage in business, commercial, or industrial enterprise.

- Limited – The liability of the members of the company is not unlimited. To understand this better, think of a sole proprietorship (SP). In an SP, the owner is liable for all debts of the business. This is unlimited liability. However, in a private ltd company, the liability is ‘limited’.

- Private – Section 2(68) of the Companies Act,2013 defines a private company. According to this section, a company whose articles of association restrict it from freely transferring shares and disallows people from subscribing to them is essentially a private company. Further, there are restrictions on the number of members too. You can incorporate a Private Limited Company with a minimum of two directors and two shareholders subscribing to the paid-up capital of the company. There is no minimum limit for the paid-up capital. Hence, the promoters of the company can decide the amount of paid-up capital.

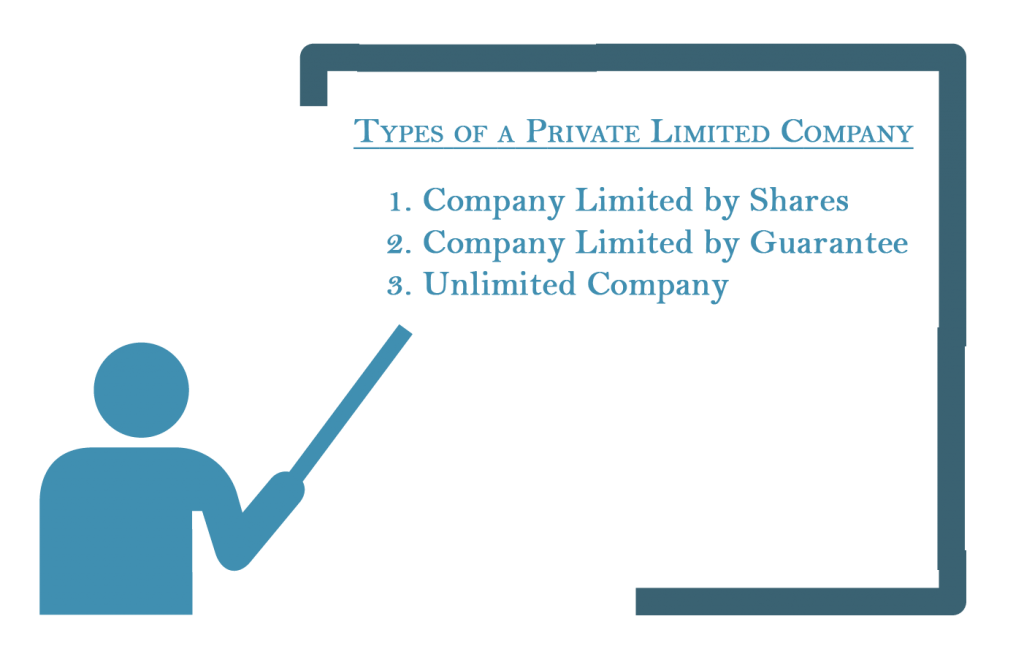

Hence, when we put the three definitions together, we understand a private limited company. There are three types of a private company as described below:

Types

In a private company, the Companies Act allows the members to limit their liability by various means as follows:

- Shares – In such a Company, the members can limit their liability up to the amount of the shares that they hold.

- Guarantee – When a company winds up, the members are liable to an amount to add to the advantages of the company. This liability is limited via a memorandum.

- Unlimited Liability – In such a company the liability of the members remains unlimited.

Like any other form of organization, a Private Company has some unique features and a few restrictions. These make them ideal for certain businesses. Before you decide on registering a Private Limited Company, take a look at its features and restrictions:

Features

- Non-Transferability of Shares– According to the Companies Act, a Private Company cannot freely transfer shares. The Act gives the Right of First Refusal (ROFR) to existing shareholders of the company

- Minimum and Maximum Members – Every Private Ltd Company must have a minimum of two members and a maximum of 200

- Minimum Number of Directors – A Private Company needs at least two Directors for incorporation. Of these, at least one needs to be a resident of India

- Separate Legal Entity – A Private Ltd Company is a separate legal entity. In other words, it has a legal identity that is separate from its members. Therefore, if the existing members fail to continue the business, the company runs with new members.

- Limited Liability – The liability of the members is limited to the extent of the shares held in the Company. Hence, the company cannot impose additional liabilities on its members.

Restrictions for a Private Company

- The shares of the Private Company are not freely transferable. The Companies Act imposes certain restrictions on it

- The number of members in the private company cannot exceed 200. In case two or more persons jointly own shares, the joint ownership is treated as a single member. The maximum limit excludes all employees and ex-employees of the company

- A private company cannot send an invitation to the public for subscription to securities of the company

At this note, allow us to share an example with you:

Example

Two brothers approached us with a problem regarding company formation. For the sake of the example, let’s call them Arun and Varun. They owned a shoe store in Delhi. As the business grew, they decided to diversify by starting a new company that will make shoes. However, they were facing a roadblock. They had managed to raise around INR 50,000 for the company but wanted to limit their liabilities. They read online that they needed at least INR 1 lakh to start a company. Arun and Varun needed a resolution.

This is a classic example of how wrong or outdated information gets circulated online. While there was a minimum paid-up capital requirement of Rs. 1 lakh earlier, the amendment to the Companies Act in 2015 had removed this requirement. Hence, they could easily register a private limited company and opt for either a company limited by liability or guarantee.

Summing Up

It is important to spend some time and effort in understanding the type of company that you want to register. One size does not fit all. Hence, you must find the right type of legal structure for your business. You can opt for a sole proprietorship, partnership, One-person company, private limited company, LLP, etc. Research well and choose wisely. In case you need any guidance or assistance, feel free to write to us.