All companies incorporated in India after November 02, 2018, and having share capital must obtain the certificate of commencement of business. The Companies (Amendment) Ordinance, 2019, makes it mandatory. This is the last stage in the process of incorporation of a company that allows you to start business and exercise borrowing powers. Today, we will discuss everything that you need to know about the certificate of commencement of business.

What does the Companies (Amendment) Ordinance, 2019, state?

According to the Ordinance, a company cannot commence business until:

- The company files a declaration within 180 days of incorporation. Further, this declaration confirms that every subscriber to the Memorandum of the company has paid the value of shares agreed.

- It also files a verification within 30 days of incorporation of its registered address with the Registrar of Companies, if required.

However, if the company fails to comply and also does not carry out any business, its name can be removed from the register of companies.

How to obtain the Certificate of Commencement of Business

Here are the steps to obtain the certificate:

- File Form INC-20A

- Attach the company’s bank account statements as proof of payments for the value of the shares

- You can also attach valid receipts as proof of payment (RTGS/ NEFT, etc.)

- File the certificate of registration issued by the Reserve Bank of India (RBI), in the case of NBFC(s)/from other regulators.

- Also, pay the prescribed fee as per the table below:

| Nominal Share Capital (Rs.) | Applicable fee (Rs.) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 100,00,000 and more | 600 |

If the company does not have a share capital, then the fee is Rs.200.

In case of delays, the additional fee rules are as follows:

| Period of delay | All forms |

| Up to 30 days | 2 times the normal fees |

| More than 30 days and up to 60 days | 4 times the normal fees |

| More than 60 days and up to 90 days | 6 times the normal fees |

| More than 90 days and up to 180 days | 10 times the normal fees |

| More than 180 days | 12 times the normal fees |

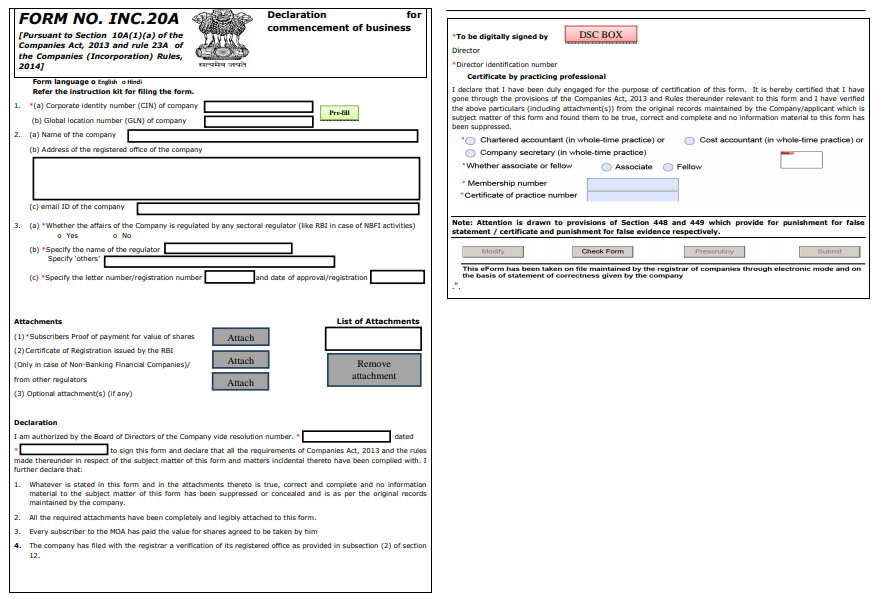

Format of Form INC-20A

According to rules, directors need to make the declaration using Form INC-20A. This is pursuant to Section 10A (1) (a) of the Companies Act, 2013 and rule 23A of the Companies (Incorporation) Rules, 2014. Here is a copy of the form:

Some quick tips for filling Form INC-20A:

- You will need a valid and active Corporate Identification Number (CIN) of the company. Also, the CIN must have an enabled flag for filing for the commencement of business.

- You can use the ‘Prefill’ button to auto-populate the fields, company name, address of the registered office, and email id of the company. If the email ID is not auto-filled, then enter a valid email ID.

- If a sectoral regulator like RBI, IRDA, SEBI, etc. regulates the company, then specify the name of the regulator along with the registration number and the date of registration.

- Attach the subscribers proof of payment for the value of shares

- Attach the Certificate of Registration issued by the RBI (Only in case of Non-Banking Financial Companies) /from other regulators. It is mandatory to attach this document if ‘Yes’ is selected in the field above.

- Enter the serial number and date of board resolution authorizing the signatory to sign, give declaration and submit the e-Form.

- A director of the company must digitally sign the form provided his DSC is registered with the MCA.

- Enter the approved Director Identification Number (DIN).

- A practicing professional must verify the e-form. Enter the details of the professional and the digital signature.

Penalty for not obtaining the certificate of commencement of business

If a company does not comply with the rules, then the penalty is as follows:

Company

A company is fined Rs.50,000 for not obtaining the certificate of commencement of business within 180 days of incorporation.

Directors

Each defaulting director of the company is fined Rs.1000 per day up to a maximum of Rs.1 lakh.

Company Strike-Off

The Registrar of Companies has the authority to suo-motto notice intending to strike-off the company if he has reasonable cause to believe that the company has not commenced business or any operations. A company strike-off means the company’s name is removed from the register of companies.

Summing Up

Being a mandatory requirement, ensure that you obtain the certificate of commencement of business within the stipulated time. We hope that this article helps you understand everything that you need to know about it. This is the final step ensuring that you can commence your business operations. Good Luck!